Launched in 2012 to support the Rwandan authorities’ ambition to make the country of the Thousand Hills a low-carbon and climate-resilient economy by 2050, the Rwanda Green Fund will change its mind. Following the last meeting of the presidential cabinet, held on Wednesday, July 15, Teddy Mugabo was appointed chief executive officer of the institution, better known as FONERWA in Rwanda. Until now head of business development of FONERWA, the new leader will have the task of continuing the efforts made by the previous management to succeed in the challenge of climate transition. This includes providing financial resources for all kinds of initiatives considered « eco-friendly »: community rooftop rainwater harvesting systems, waste management, affordable zero-carbon housing, a 500-kW hydroelectric power plant along the Gaseke River, etc.

De News

Uganda’s oil and gas sector: Uganda puts its money where its mouth is to strengthen its local training programmes

Anticipating the growing need for skilled local labour that will arise with the upcoming start of oil exploitation in the country - expected in 2023 - the Ugandan government has released 5.4 million dollars, intended to strengthen training related to the hydrocarbon sectors (oil & gas). Out of this package, 8 billion shillings (US$2.4 million) will be used to launch the Kichwamba Technical College, a public institution of higher learning, which will offer training in welding, metal fabrication, electrical installation and plumbing, among others. The new public educational institution will join the Uganda Petroleum Institute in Kigumba, which has so far been the only state institution producing world-class certified technicians. The authorities have also called on the private sector to join the government’s efforts to rapidly offer further training in these fields.

Kenya: Tea sector exports less

The latest edition of the World Bank’s Commodity Markets Outlook predicted it: in the wake of the coronavirus health crisis, tea selling prices have plummeted everywhere due to weak global demand. The latest figures from Kenya, the world’s largest exporter of black tea, confirm this. According to data released on 10 July by the Tea Directorate, Kenya’s regulator of the industry, revenue from domestic tea exports fell by 1.3 billion shillings (US$13 million) in the first five months of the year, as the negative impact of the coronavirus crisis resulted in a drop in the average price per kilogram compared to the same period last year (from 238 shillings to 223 shillings). As for the volumes sold, between January and May, the country sold six million kilos less than during the same period in 2019, the Kenyan public agency said.

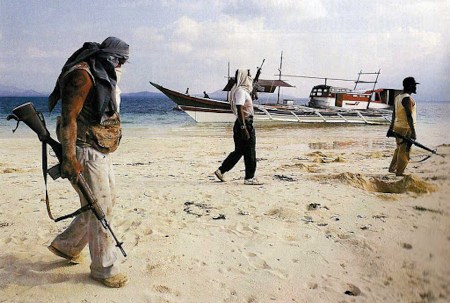

Somalia: When illegal fishing threatens national and regional economy

The stakes: to understand, through data assessed for the first time, how the phenomenon of illegal fishing destabilizes the country and the sub-region, and the need to put in place strong enough maritime regulations to counter this phenomenon.e en place une réglementation maritime suffisamment forte pour pallier ce phénomène Estimated at USD 300 million according…

Zambia: the copper industry is on the rise, despite the coronavirus health crisis

The second largest copper producer on the African continent, Zambia continues to perform well despite the coronvairus health crisis. On Thursday 9 July, the Ministry of Mines announced that the country’s copper production reached 342,734 tonnes in the first five months of this year, an increase of 3.85% compared to the same period in 2019 (330,024 tonnes). Better still, according to the Zambian authorities, copper production is expected to continue to grow in the third and fourth quarters, due to higher prices linked to factors such as the growing production of electric vehicles, which depend on copper. This optimistic projection, if realised, will further reinforce the strategic importance of copper in the Zambian economy: revenues from ore mining account for 70% of the country’s export earnings.

Mining: Sundance Resources issues ultimatum to Chinese partner AustSino

The stakes: For Australian Sundance Resources, to finally start operating the Mbalam-Nabeba project. Historic operator of the Mbalam-Nabeba mining project, Australian Sundance is giving its Chinese partner AustSino one last chance to reach a final agreement. For Australian Sundance Resources, which has been piloting the Mbalam-Nabeba iron ore mining project on the Cameroon-Congo Brazzaville border…

Despite a difficult economic climate, Benin maintains its cotton prices

Stake : For Benin, to support the cotton sector, a key sector of the national economy, at all costs. In contrast to other producing nations in the sub-region, Benin has decided to keep the price per kilo of cotton unchanged for the 2020/2021 campaign. The country thus confirms its strong support for the country’s very…

Cocoa: Covid-19 exposes the fragility of mechanisms to combat child labour

Stake: to identify the impact of Covid-19 on the well-being of the farmers and particularly their children, as well as the solutions to be provided to prevent the worsening of an already precarious situation. Between 17 March and 15 May 2020, the International Cocoa Initiative (ICI) Foundation analysed data from 263 cocoa-producing communities (1,443 households…

Sales of Rwandan agricultural products boosted by the e-commerce platform Alibaba

Launched in Kigali in November 2018 as the first African hub of the Chinese e-merchant Alibaba, the eWTP platform (for « Electronic World Trade Platform ») has succeeded in significantly increasing exports from the country of the Thousand Hills, particularly to the Middle Kingdom. According to information made public by the Chinese e-commerce giant, sales of Rwandan products in China, via eWTP, increased by 124% in 2019. Rwandan coffee and chilli pepper are the most popular items among Asian consumers. Organised in May by Alibaba, a recent sale of roasted Rwandan coffee resulted in the sale of around 1.5 tonnes of goods in one minute!

Egypt hits the jackpot with the discovery of a large gold deposit

Stake: For Egypt, to increase its gold production capacity in a favourable economic context. A modest gold producer, Egypt could soon see its industry strengthened. The Egyptian Minister of Petroleum and Mining Resources, Tarek El-Molla, announced on Tuesday 30 June the discovery of a major deposit in the south-east of the country. According to the…

Gas: UKEF announced in roundtable of Mozambique LNG project

Estimated at $25 billion, the mega-project for the construction of the Mozambique LNG liquefaction and gas export terminal, led by France’s Total, has received new financial support. According to the Reuters news agency, which reported the information on Monday 29 June, the British export credit agency UK Export Finance (UKEF) would thus be ready to participate in the financing of the project, a source close to the dossier indicated. As for the possible amount granted, the funds committed to the operation could be « around 800 million dollars », the source said. Contacted by Reuters to confirm (or deny) this intention, a spokeswoman for the British agency said that « UKEF cannot comment on speculation on potential transactions for reasons of commercial confidentiality ».

Cocoa: Côte d’Ivoire reinforces its processing and storage capacities with China’s help

Determined to make the most of the national cocoa, which is still too often sold in its raw state, the Ivorian authorities have undertaken a series of projects to strengthen the country’s processing and storage capacities: the construction of two new cocoa grinding plants and around ten warehouses has been approved by the Ministry of Economy and Finance. As for the financing of these facilities, according to sources reported by the weekly Jeune Afrique, it should be made possible by means of a loan « of about 330 million euros » from Chinese operators, already active in the Ivorian cocoa industry. The best known of these is the Chinese state-owned company China Light Industry Design Co Ltd, which had already signed a similar agreement in December with the Coffee-Cocoa Council for the construction of cocoa processing plants and storage warehouses in Abidjan and San Pedro.

Senegal: Australian junior FAR defaults on payment

The Australian junior FAR announced on 24 June to the authorities of the Sydney Stock Exchange, where it is listed, that it was defaulting on its financial commitments on the Senegalese offshore oil project of Sangomar, in which it is a 15% shareholder, alongside its compatriot Woodside (35%), the Scottish company Cairn Energy (40%) and the Senegalese public agency Petrosen (10%). According to the press release, the default follows a call for funds issued in May 2020 by Woodside for the month of June 2020 and a delay in the payment of 100 million dollars of FAR, which had one month to settle this call for funds, in accordance with its obligations. The company has six months to pay its debts. Beyond that period, FAR will be forced to relinquish its participation in the project without compensation.

Harmony Gold Raises Funds on the Stock Exchange to Complete Latest Acquisition

Stake: for Harmony Gold, the call to the market allows it to complete its financial round. Officially announced in February, Harmony Gold’s acquisition of AngloGold’s last South African gold assets for $300 million was to be partly financed by raising funds on the markets. This has now been done. In a press release issued on…

Senegal: Woodsite confirms that the Sangomar oil project will get off to a good start in 2023

Faced with the fall in gas prices during this period of crisis, and persistent rumours of a postponement of its investment plans in Senegal, Australian Woodside recalled on 23 June that its flagship Sangomar project will get off to a good start in 2023, as planned. The announcement sounds like a clarification, as some analysts recently indicated that the well is unlikely to come on stream before 2025, due to the impact of the coronavirus on the sector. « Together with our partners, we are working with the project contractors and the government of the Republic of Senegal to optimize expenditures in the short term while protecting the overall value of the investment and deliver the first oil in 2023, » the firm’s management said in its press release.

DRC: Canada’s Banro sells its Namoya gold mine

Weary of the problematic security situation in the east of the Democratic Republic of Congo, the Canadian gold group Banro announced on Tuesday 23 June the forthcoming sale of its Namoya mine to a consortium of investors including the Chinese operator Baiyin International Investment. Earlier, in February, Banro had in fact confirmed its intention to sell the Namoya mining complex - if necessary at a substantial discount - after repeated attacks by local Congolese militias forced the company to suspend operations at several of its sites, all located in the east of the country. Although the amount of the transaction was not disclosed, the Canadian group said it will receive a royalty for all future gold production from the Namoya site. However, the agreement is still subject to final approval by the Congolese government.

Tesla relaunches Glencore’s Congolese cobalt

Stake : securing a reliable supply of cobalt to support the development of electric cars. The Congolese cobalt industry could soon be relaunched thanks to the increased needs of the American car manufacturer Tesla, whose operations at the Mutanda mine have been suspended at the end of 2019. The group, which specialises in electric vehicles,…

COVID-19: The decline of global remittances puts rural families at risk

In this op-ed piece, Pedro de Vasconcelos, Head of the Financing Facility for Remittances at the UN’s International Fund for Agricultural Development (IFAD, discusses the global consequences of the sharp decline in migrant remittances - and possible levers for action - in the wake of the economic crisis caused by the coronavirus pandemic. A fall…

Oil: ConocoPhillips back in Morocco

The American oil company ConocoPhillips, through its subsidiary Conocophillips Morocco Ventures (CMV), has just been awarded an offshore exploration perimeter in the Mesorif region (north of the country) by the Moroccan Office of Hydrocarbons and Mines (ONHYM), an area that has already been the subject of several hydrocarbon discoveries. The information was made public on 12 May by ONHYM, which welcomed, in its press release, that « this signature marks a new entry of ConocoPhillips in the Cherifian Kingdom since the merger of Conoco and Phillips in 2001 ». The Cherifian public institution also specified that the exploration permit will cover a period of two years, with CMV having to carry out geological and geophysical studies during the first year and the acquisition of 2D data during the second year.

Ghana: The Cocobod, bad payer

Ghana’s cocoa industry (850,000 tonnes per year), the world’s second largest producer behind its neighbour Côte d’Ivoire, is going through a difficult financial period. According to indiscretions reported by the financial information agency Bloomberg, Cocobod, the Ghanaian regulatory authority of the sector, has multiplied the unpaid amounts in recent weeks from companies approved to purchase cocoa, which deliver the beans after collection from the producers. According to sources quoted by the American media, these debts are estimated to reach cumulative arrears of nearly 1.2 billion cedis (210 million dollars). This was due to the fall in cocoa prices and the disruption of global supply chains in the wake of the coronavirus crisis, which severely affected the regulator of the Ghanaian cocoa sector. Contacted by Bloomberg, the Cocobod’s management, however, was reassuring, explaining that « sales are being normalized » and that all debts will be paid « in the coming weeks ». To be continued…

Guinea: AfDB Grants US$ 3 Million for Green Energy and Honey Sectors

The African Development Bank (AfDB) Group has approved the financing of three new projects in Guinea, notably in the areas of green energy and support to the competitiveness of the honey value chain, it was learnt on Thursday, 11 June. With regard to the renewable energy component, the development programme for mini-green networks in Guinea will in particular support the Guinean Rural Electrification Agency (AGER) in the implementation of 57 mini-green network projects in the country. As for support for the Guinean honey sector, the project to support the competitiveness of this value chain aims to increase the incomes of its actors, particularly women. A total of nearly US$ 3.2 million in new financing will be provided, bringing the total amount of AfDB-financed projects in the country to US$ 556 million.

South Africa’s Sun Exchange raises $3 million for solar energy

Stake : For the solar start-up Sun Exchange to secure long-term funds for its future African projects. South African start-up Sun Exchange, which specialises in raising funds for solar energy projects, announced the closing of its Series A financing round with an additional $3 million from the Africa Renewable Power Fund (ARPF), an entity controlled…

Guinea Signs Simandou Project Convention

As recently announced in our columns, the basic agreement for the exploitation of Blocks 1 and 2 of Mount Simandou by the Guinean-Chinese consortium Société minière de Boké (SMB-Winning) was officially signed on Tuesday June 9 by the Minister of Mines, Abdoulaye Magassouba, who referred to « an important step in the development of the Guinean mining sector ». The agreement, which should concretely result in the start of the largest industrial mining project of the country, notably includes the construction of a 650 km railway line and a deep-water port. The total cost of the project is estimated at $14 billion and is expected to generate $15 billion in cumulative revenues for Guinea over its 25-year life.

Togo, the leading exporter of organic agricultural products from ECOWAS to the EU

Considered as one of the priorities of the National Development Plan, Togo’s agricultural sector can already congratulate itself on its first symbolic victory: according to the latest figures published by the European Commission, in 2019 Togo became the leading exporter of organic agricultural products from the Economic Community of West African States (ECOWAS) to the European Union (EU) and the second largest on the continent, after Egypt. Better still, the small West African country (56,000 km2 for 8.6 million inhabitants) saw its volumes shipped to the EU more than double (+102%) between 2018 and 2019, with its exports of organic agricultural products to this destination rising from 22,000 tonnes to nearly 45,000 tonnes over the period.

Libya: NOC confirms the resumption of activity in two oil fields

The National Oil Corporation (NOC), Libya’s national oil company, confirmed on Monday June 8 that production from the Sharara and El Feel fields has resumed following the withdrawal of forces from Khalifa Haftar, the dissident marshal who opposes the Tripoli-based Government of National Accord (GAN). According to the Reuters news agency, which quotes two NOC oil engineers, the El Feel oil field is currently producing 12,000 barrels a day, a level that is expected to rise to 70,000 barrels a day within 14 days. As for the Sharara field, production has resumed at 30,000 barrels per day, a volume that will be gradually increased to its full potential (300,000 barrels per day) over the next three months. This is certainly good news for Libya’s public finances: in its latest press release, the NOC pointed out that the collapse of hydrocarbon production and the closure of oil ports since the beginning of the year have caused the country to lose 5.3 billion dollars in revenue.